The price of TORN, the native token of the Tornado Cash protocol, has skyrocketed by over 75% following reports that the US Treasury has removed Tornado Cash from its sanctions list. This unexpected development has reignited discussions surrounding privacy in crypto transactions, government regulations, and the role of decentralized finance (DeFi) in financial privacy.

What is Tornado Cash?

Tornado Cash is a cryptocurrency mixer built on the Ethereum blockchain, designed to enhance transaction privacy. It works by breaking the link between the sender and recipient of funds, making transactions more anonymous. This is achieved by pooling together multiple deposits and then allowing withdrawals from a shared liquidity pool, obscuring transaction origins.

Originally, Tornado Cash was seen as a privacy-preserving tool for users who wanted to protect their financial activity from public scrutiny. However, its anonymizing features made it attractive to cybercriminals, including state-backed hacking groups such as North Korea’s Lazarus Group.

Why Was Tornado Cash Sanctioned?

In August 2022, the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash, accusing it of facilitating money laundering operations. The Treasury alleged that Tornado Cash was used to launder over $7 billion in illicit funds since 2019, including $620 million stolen from the Ronin sidechain, a gaming-focused Ethereum blockchain, by North Korean hackers.

The sanctions led to a severe crackdown on the platform. The arrest of Tornado Cash developer Alexey Pertsev in the Netherlands further escalated tensions. His arrest sparked debates on whether developers should be held accountable for how their open-source code is used.

Additionally, several Ethereum addresses associated with Tornado Cash were blacklisted, leading to significant consequences:

- Many DeFi platforms began blocking Tornado Cash-associated wallets.

- GitHub suspended the accounts of Tornado Cash developers.

- The price of TORN plummeted as exchanges delisted the token.

Recent Developments: US Treasury Removes Tornado Cash from Sanctions List

In a surprising move, the US Treasury has now removed Tornado Cash from its list of sanctioned entities. The decision has led to speculation about whether this indicates a shift in regulatory approaches toward crypto mixers or whether the original justification for the sanctions was legally or politically weak.

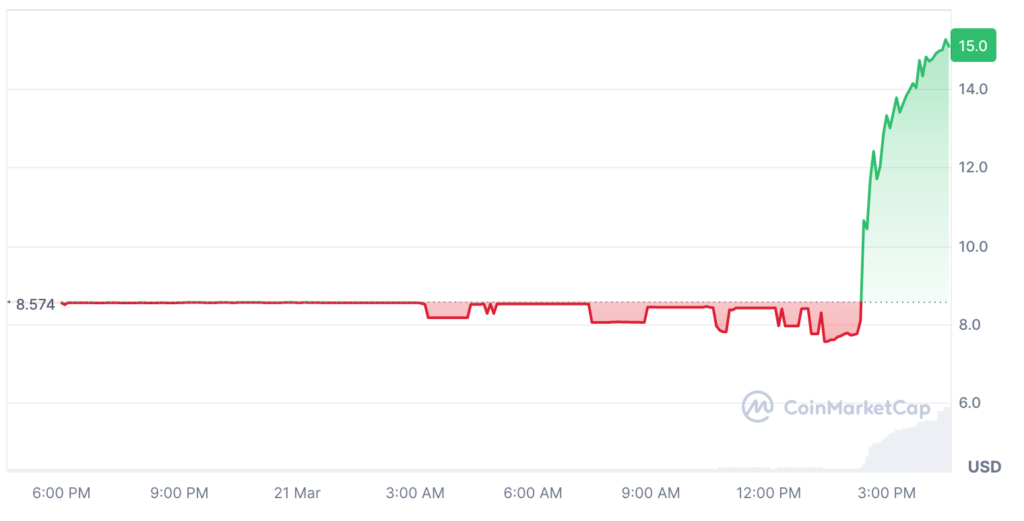

The removal of Tornado Cash from the blacklist has caused a rapid surge in TORN’s price, with a 75% increase recorded within hours of the announcement. This price jump reflects renewed investor confidence and suggests that traders expect Tornado Cash to regain its utility in the DeFi space.

Implications of the Removal

The removal of Tornado Cash from the sanctions list has several major implications:

1. Legal Precedent for Crypto Regulation

This decision may set a precedent for how regulators approach privacy-enhancing blockchain tools. Many in the crypto industry had criticized the US Treasury’s initial move, arguing that banning software rather than targeting specific bad actors was an overreach. The reversal suggests that regulators may have reconsidered the feasibility of banning decentralized technologies.

2. Renewed Debate Over Financial Privacy

Privacy advocates have long argued that tools like Tornado Cash are essential for ensuring financial privacy in an era of increasing government surveillance. The platform’s removal from the blacklist could reinvigorate efforts to build privacy-preserving tools that comply with regulations while still providing anonymity.

3. Potential Market Reactions

With Tornado Cash no longer under direct sanctions, exchanges and DeFi platforms may reconsider integrating TORN and allowing its use on their platforms. This could lead to further price surges as liquidity returns to the token and more users adopt the protocol.

4. Uncertainty Around Developer Accountability

Despite Tornado Cash’s removal from the sanctions list, legal uncertainties remain. Developers like Alexey Pertsev still face legal challenges, and regulators may continue pursuing individual developers even if the platform itself is no longer blacklisted.

What’s Next?

The recent 75% surge in TORN’s price following the US Treasury’s decision to remove Tornado Cash from the sanctions list highlights the complex intersection of privacy, regulation, and financial freedom in the crypto space. While this move offers relief to Tornado Cash users and privacy advocates, the future of crypto mixers remains uncertain. Regulators are likely to continue exploring ways to balance privacy rights with efforts to prevent financial crimes.

For now, Tornado Cash’s revival could mark a new chapter in DeFi privacy tools, but only time will tell whether this marks a lasting regulatory shift or just a temporary market reaction.