The world of cryptocurrency never stands still. From Bitcoin ETFs making waves on Wall Street to stablecoins offering a lifeline in countries battling economic turmoil, the latest trends reveal a dynamic and rapidly evolving landscape.

Global Crypto Adoption: A Bird’s-Eye View

The numbers tell a compelling story: global crypto activity surged between Q4 2023 and Q1 2024, even outstripping the levels seen during the 2021 bull market. This isn’t just a flash in the pan; it signals a deeper integration of crypto into the financial mainstream. While last year’s growth was fueled by lower-middle-income countries, this year, we’re seeing increased activity across all income brackets. Even high-income countries are in the mix, although they’ve experienced a slight pullback since the start of 2024.

Bitcoin’s Big Moment and the Rise of Stablecoins

Bitcoin has been on a tear, thanks in part to the launch of Bitcoin ETFs in the U.S. These ETFs have opened the doors for institutional investors, leading to a surge in large Bitcoin transfers, especially in North America and Western Europe.

But that’s not the whole story. Stablecoins are also playing a crucial role, particularly in lower-income countries. In places like Sub-Saharan Africa and Latin America, stablecoins are becoming essential tools for everyday transactions.

Regional Rundown: Where Crypto Adoption is Booming

Let’s take a closer look at how different regions are embracing crypto:

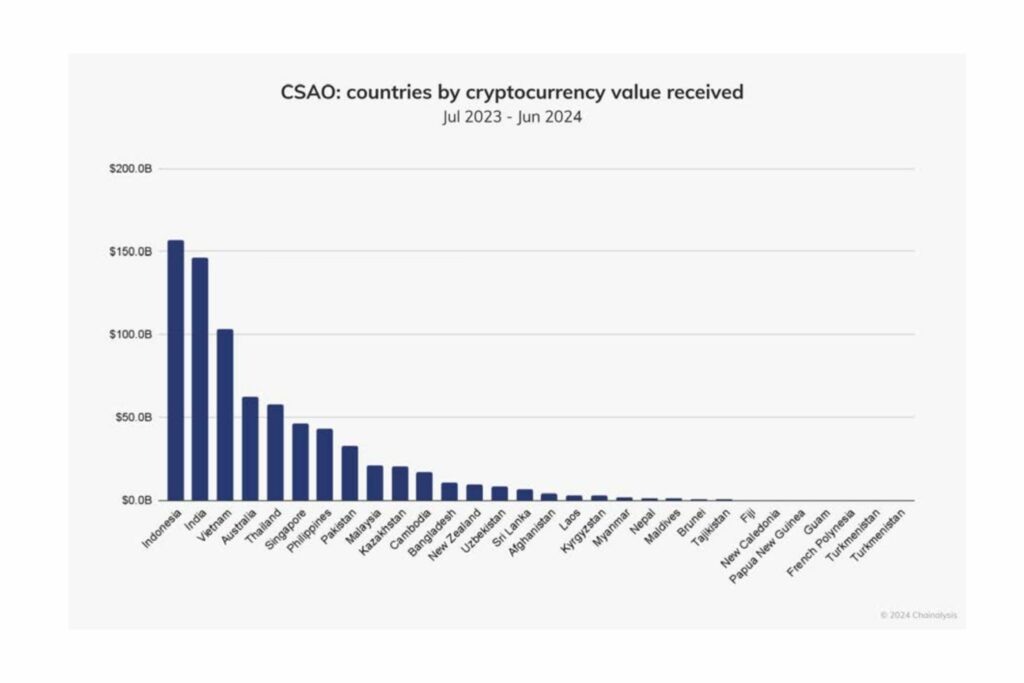

- Central & Southern Asia and Oceania (CSAO): This region is a global leader in crypto adoption. Countries like India, Indonesia, Vietnam, the Philippines, Pakistan, Thailand, and Cambodia are all in the top 20 for adoption. Here, crypto is thriving, driven by centralized exchanges and significant professional and institutional activity.

India leads the world in grassroots adoption despite a 30% crypto capital gains tax and a 1% tax deducted at source (TDS). India ranks second in the CSAO region for cryptocurrency value received. The Financial Intelligence Unit (FIU) in India has engaged with offshore exchanges regarding compliance.

Indonesia leads the CSAO region in terms of cryptocurrency value received9 . Its market is dynamic, driven by trading opportunities, and has the highest year-over-year growth in the region. There’s a growing interest in meme coins, and professional trading activity is significant. Indonesia also shows a higher share of DEX and DeFi activity compared to other countries in the region and the global average.

Singapore’s crypto market has historically been institutionally driven but is seeing increased participation from retail and professional investors. There is a growing adoption of crypto for merchant services, including by major apps like Grab. Regulatory clarity in Singapore may be boosting confidence in stablecoins.

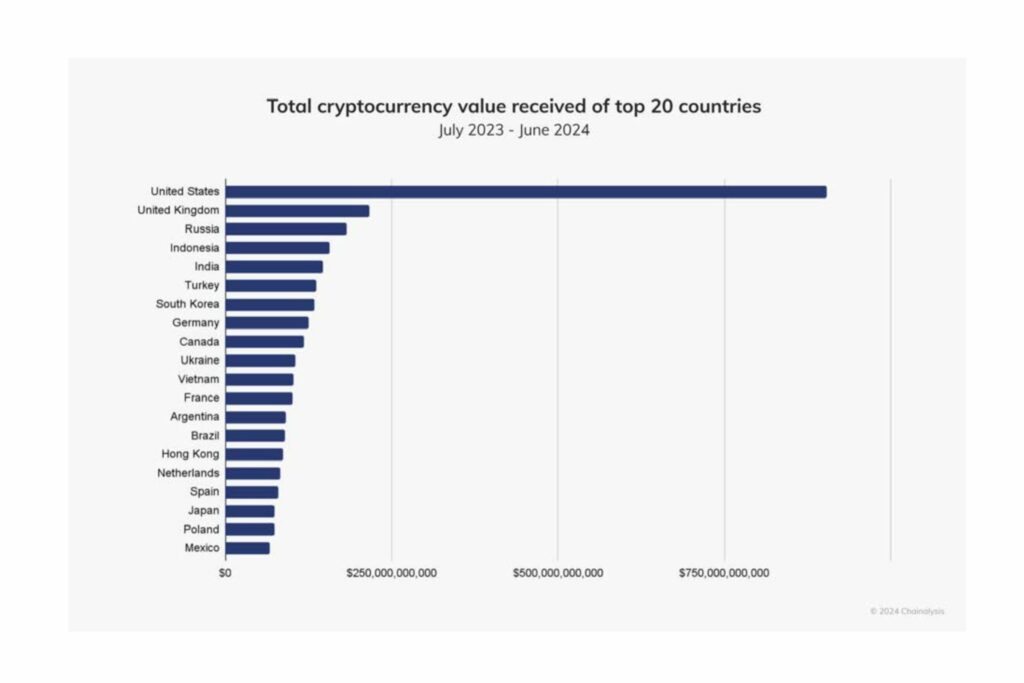

- North America: Remains the largest cryptocurrency market globally. Dominance is largely fueled by institutional activity, with a high percentage of large transfers. The United States is the foremost pillar of global crypto adoption, ranking fourth globally. The launch of spot bitcoin ETPs in the U.S. has had a transformative impact, driving institutional interest and inflows into BTC. The U.S. is emerging as a dominant global user of centralized services. However, stablecoin growth has stalled in U.S. markets, potentially due to regulatory uncertainty. Canadian markets follow U.S. trends closely but with less volatility. Stricter regulations have led some major crypto businesses to suspend operations, but regulated venues are still available. Gaps remain in the regulation of stablecoins and DeFi, and major FIs are reluctant to engage meaningfully with crypto.

- Latin America: Latin America is the second fastest-growing region studied. Crypto adoption is surging here, with countries like Venezuela, Argentina, and Brazil leading the charge. Argentina is seeing stablecoins provide a path to stability amidst long-standing economic turmoil and high inflation. Retail-sized stablecoin value received is growing at the fastest rate compared to other assets Brazil is seeing renewed interest from major financial institutions, with increased institutional crypto activity.

- Eastern Europe: Despite the challenges of war and regulatory uncertainty, crypto adoption is growing, driven by institutions and DeFi activity. It is the fourth largest cryptocurrency market.

Ukraine and Russia ranked 6th and 7th respectively in the global adoption index. DeFi activity grew significantly, placing third globally in year-over-year growth. Decentralized exchanges saw the greatest increase in crypto inflows. There has been a notable decline in stablecoin volumes in the region, potentially due to regulatory uncertainty and geopolitical tensions. - Sub-Saharan Africa: Sub-Saharan Africa accounts for the smallest share of the global crypto economy but is experiencing remarkable momentum. Nigeria ranks 2nd globally in the adoption index and is a ground zero for crypto activity in the region. Crypto is used for everyday activities, and stablecoins are a major part of the economy. Cross-border remittances are a key use case for stablecoins in Nigeria. DeFi is also experiencing significant growth in Nigeria.

Sub-Saharan Africa leads the world in DeFi adoption, driven by the need for accessible financial services. Stablecoins are driving economic resilience and global connectivity across the region, acting as a hedge against inflation and facilitating international payments. Ethiopia is the fastest-growing market for retail-sized stablecoin transfers.

South Africa’s crypto market is thriving, spurred by growing institutional activity and TradFi involvement. There is increasing interest in custody solutions for digital assets, and the regulatory environment is relatively favorable. - Eastern Asia: The sixth-largest crypto economy, Eastern Asia is seeing adoption driven by institutions, particularly in South Korea and Hong Kong. South Korea is the largest market in the region, with increasing transaction value. Mistrust in traditional financial systems and corporate adoption of blockchain are contributing to growth. There is significant trading activity in altcoins and stablecoins. South Koreans often use local exchanges to on-ramp and move funds to global exchanges for arbitrage opportunities like the “kimchi premium”.

Hong Kong has emerged as a crypto hub in the Greater China region due to regulatory openness, experiencing the largest year-over-year growth in Eastern Asia. Supportive regulatory frameworks are fueling institutional adoption.

In China, despite government crackdowns, citizens use crypto, particularly through over-the-counter (OTC) platforms, to preserve wealth and move money out of the country amid economic uncertainty. - Middle East & North Africa (MENA): The 7th-largest crypto market globally. Majority of activity is driven by institutional and professional-level activity. Türkiye ranks as the largest crypto market in MENA and seventh globally. High inflation has driven citizens to stablecoins and altcoins to hedge against currency devaluation.

The UAE is experiencing rapid growth, driven by regulatory innovation and institutional interest, with balanced adoption across transaction sizes and significant DeFi activity. Dubai’s Virtual Assets Regulatory Authority (VARA) is playing a critical role.

Saudi Arabia is the fastest-growing crypto economy in MENA, with a focus on blockchain innovation and fintech. Stablecoins and altcoins are gaining market share across MENA. DeFi is gaining traction, particularly in Saudi Arabia and the UAE.

Key Factors Driving Crypto Adoption

Several factors are fueling this global surge in crypto adoption:

- Institutional Investment: The entry of traditional financial giants like BlackRock, Fidelity, and Goldman Sachs is lending legitimacy to the crypto space.

- Regulatory Developments: Clear regulatory frameworks, like the EU’s MiCA, are fostering confidence and attracting investment.

- Economic Instability: In countries facing high inflation or currency devaluation, stablecoins are providing a safe haven and a means to access the stability of the U.S. dollar.

- Financial Inclusion: DeFi and stablecoins are offering access to financial services for the unbanked and underbanked, particularly in regions like MENA and Sub-Saharan Africa.

Challenges and Opportunities

Despite the impressive growth, the crypto industry faces challenges. Regulatory uncertainty remains a concern in some regions, and the shift of stablecoin activity away from U.S.-regulated platforms highlights the need for clear and balanced regulations.

However, the opportunities are immense. As crypto adoption grows, it has the potential to transform financial systems, drive economic growth, and empower individuals around the world.

Source: Chainalysis, Oct. 2024, The 2024 Geography of Crypto Report