Imagine you’re at a bakery, eyeing a delicious chocolate cupcake. You hand over a crisp $5 bill, and the baker gives you the cupcake. Simple, right? But what if you could magically photocopy that $5 bill and spend it again at the next shop? That’s a big no-no in the world of money—it’s called “double spending,” and it’s a problem that’s plagued digital cash for years. Enter Bitcoin, the clever invention that cracked this nut wide open, and in doing so, kicked off a revolution. In this article, we’ll explore how Bitcoin solves the double spend problem, sprinkle in some fun facts about its mysterious creator Satoshi Nakamoto, and explain why it’s such a big deal—all in a way that’s as easy to digest as that cupcake. Let’s dive in!

“If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.”

Satoshi Nakamoto

Who’s Behind Bitcoin? Meet Satoshi Nakamoto (Sort Of)

Bitcoin burst onto the scene in late 2008, right as the global financial system was wobbling like a Jenga tower. Its creator? A mystic figure (or group) known as Satoshi Nakamoto. There have been lots of speculations around who is Satoshi, so here is the latest claim as debated by Anthony Pompliano and Phil Rosen on HBO documentary.

Regardless of all the claims, one is still unsure who stands behind this acronym. Satoshi published a nine-page white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System, which you can still find online — it’s like the recipe for Bitcoin’s secret sauce. Nobody knows who Satoshi really is. A brilliant coder? A team of cryptographers? A time traveler from the future? The mystery adds a dash of intrigue, but what’s clear is that Satoshi’s idea was pure genius. On January 3, 2009, the Bitcoin network went live, and the first “coins” were born. Back then, a bitcoin was worth less than a penny. Fast forward to today, and it’s been valued in the tens of thousands of dollars. Not bad for a digital experiment, huh?

What’s So Special About Bitcoin?

So, what makes Bitcoin stand out from the crowd? It’s all about solving that pesky double spend problem. Picture this: when you email a photo to a friend, you both end up with a copy. That’s fine for cat pics, but disastrous for money. If I send you $10 digitally and keep a copy to spend again, chaos ensues. Before Bitcoin, digital cash systems relied on banks or companies like PayPal to play referee, making sure no one cheated. But those middlemen charge fees, slow things down, and aren’t always available — like for the two billion people worldwide without bank accounts.

Bitcoin flips the script. It’s the first digital cash that lets you send money directly to someone else, no bank required, while guaranteeing you can’t spend the same coin twice. How? Through a clever combo of technology and teamwork. Bitcoin uses a decentralized network —thousands of computers (called nodes) spread across the globe —working together to keep an honest ledger. These nodes are run by volunteers called “miners,” who use their computing power to check transactions and solve tricky math puzzles. When a miner validates a batch of transactions (a “block”), they add it to the blockchain and get rewarded with new bitcoins. It’s like a global game of “trust but verify,” and it works like a charm.

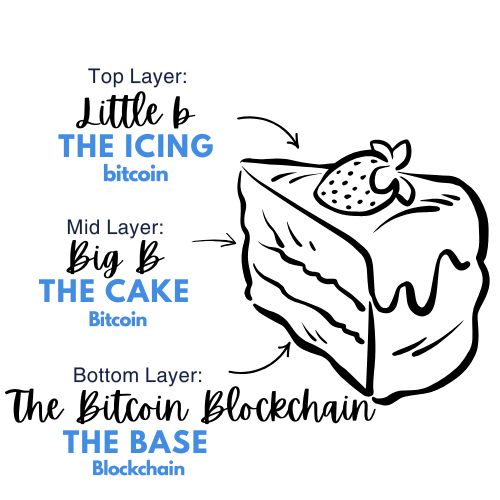

Bitcoin as a Three-Layer Cake: A Tasty Analogy

To really get Bitcoin, let’s imagine it as a three-layer cake—because who doesn’t love cake? Hilary Carter, in her awesome guide Journey to Blockchain: A Non-Technologist’s Guide to the Internet of Value, breaks it down perfectly, and I’m borrowing her delicious analogy here.

- Top Layer: “Little-b” bitcoin (the Icing)

This is the part everyone sees—the actual coins you can spend or trade, written with a lowercase “b” (bitcoin). Think of these as the sprinkles on top: the units of value zooming around the network. Just like stocks have ticker symbols (Microsoft’s is MSFT), bitcoin’s symbol on exchanges is BTC. It even has a cool character, ₿, with two lines through a B, like a dollar sign’s hip cousin. Typing ₿ isn’t easy yet, but someday it’ll be as common as the Euro’s €. This layer’s all about the money you can use—shiny, digital, and ready to roll. - Middle Layer: “Big-B” Bitcoin (the Cake Itself)

Here’s the meaty middle, written with a capital “B” (Bitcoin). This is the software protocol—the rulebook Satoshi Nakamoto wrote that keeps everything running smoothly. It’s less flashy than the icing, but without it, there’d be no cake! These rules decide how transactions work, how miners get rewarded, and more. Changing them? Tough luck—you’d need 95% of the network to agree on a Bitcoin Improvement Proposal. It’s like convincing a huge family to switch Thanksgiving recipes—possible, but rare. This layer’s the brains of the operation. - Bottom Layer: The Bitcoin Blockchain (the Base)

The foundation holding it all up is the Bitcoin blockchain. This is the permanent record book, tracking every single bitcoin transaction ever made. Every time you spend or receive bitcoin, it’s logged here, locked in forever. No one—not even Satoshi—can erase or tweak it. It’s like a magical diary that grows longer with every block miners add, roughly every 10 minutes. This layer stops double spending dead in its tracks, and it’s the real hero of our story.

How Bitcoin Stops Double Spending: The Magic Trick Revealed

Okay, let’s zoom in on the double spend problem and how Bitcoin fixes it. Say I try to send the same bitcoin to you and my buddy Jake. In a regular digital system, I might get away with it if no one’s watching. But Bitcoin’s blockchain is like a nosy neighbor who never sleeps. Here’s how it works:

- The Transaction Broadcast: I send you 1 BTC via my wallet app. That request goes out to the whole Bitcoin network—thousands of nodes hear about it instantly.

- Miners Step In: Miners race to verify my transaction. They check the blockchain to make sure I haven’t already spent that bitcoin somewhere else. It’s like a global fact-checking squad.

- The Block Party: Once verified, my transaction gets bundled with others into a block. A miner solves a cryptographic puzzle (think Sudoku on steroids) to seal the block, adding it to the blockchain. This takes about 10 minutes.

- Locked Forever: Once it’s in the blockchain, that bitcoin is officially yours—no take-backs! If I try to send it to Jake too, the network will see it’s already spent and say, “Nice try, pal.”

This setup makes cheating impossible without controlling over half the network’s computing power—a feat so pricey and tricky, it’s not worth it. The blockchain’s transparency (anyone can check it) and immutability (no edits allowed) seal the deal.

What’s the Big Deal About Bitcoin?

Now, you might wonder, “I can already shop online or send money—why do I need Bitcoin?” Fair question! Current systems work, but they’re clunky. Bank transfers can take days, and companies like PayPal charge fees—sometimes hefty ones. For folks in developing countries, it’s worse: sending money home can cost up to 22.7% in fees between some African nations. Bitcoin slashes those costs and speeds things up, needing just a phone and an internet connection. For the unbanked, it’s a game-changer—suddenly, they’re in the financial game.

Plus, Bitcoin’s not just money—it’s a movement. It’s got no CEO, no headquarters, just a global community of believers building a new kind of economy. It’s sparked over 2,500 other cryptocurrencies and inspired billions in investment. Jobs are popping up, and old-school paper-pushing gigs might vanish. It’s “money over Internet protocol,” as Alex Mashinsky put it — fast, cheap, and borderless.

Why It Matters to You

Bitcoin’s solution to double spending isn’t just techy trivia—it’s a peek into a future where value moves as easily as a text message. Whether you’re a business owner, a curious newbie, or just someone who hates bank fees, Bitcoin’s got something to say. It’s the first taste of the “Internet of Value,” where assets like money, property, or even votes can zip around securely without middlemen.

Disclaimer

Mintzn.com is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please familiarize yourself with our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.