The cryptocurrency market is experiencing a significant upward movement today, March 24, 2025. Investors and analysts are closely watching the developments, trying to understand what is driving this surge. Several factors, including macroeconomic trends, institutional adoption, technical market signals, and regulatory advancements, are contributing to this bullish momentum.

The Historical Context of Crypto Market Trends

Before diving into the specifics of today’s price surge, it’s essential to understand historical trends in the cryptocurrency market. Over the past decade, crypto markets have followed cyclical patterns influenced by Bitcoin halvings, macroeconomic policies, and technological advancements.

- Bitcoin Halving Cycles: Historically, Bitcoin’s price tends to surge within 12-18 months after each halving event. The last halving took place in 2024, leading many analysts to predict a bullish market in 2025.

- Institutional Adoption: Over time, more institutions have started integrating cryptocurrency into their portfolios, increasing overall market liquidity and reducing volatility.

- Regulatory Developments: Governments worldwide have gradually shifted their stance from banning to regulating crypto, improving investor confidence.

Factors Driving Today’s Crypto Market Surge

1. Bitcoin’s Bullish Price Discovery Phase

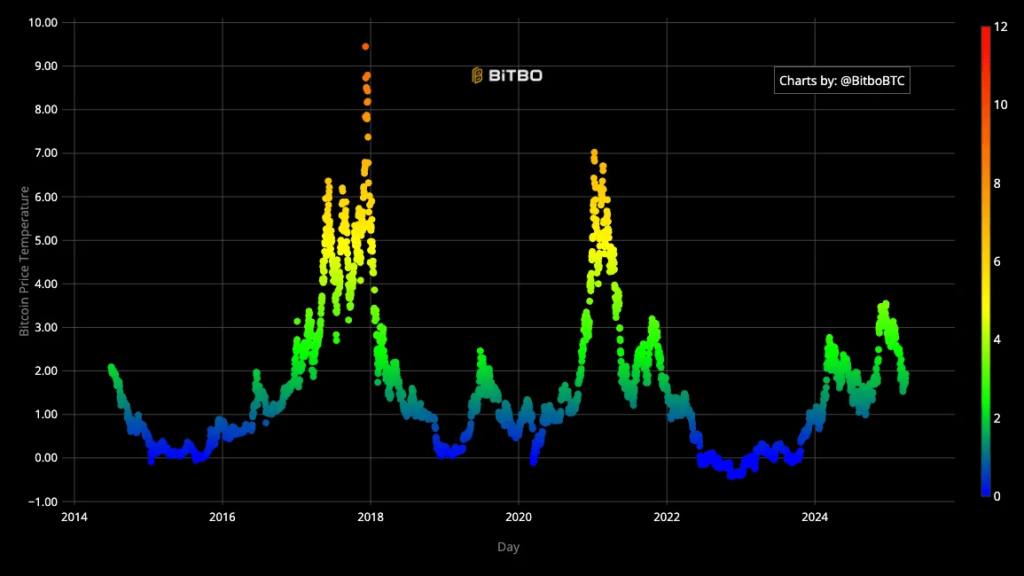

Bitcoin, the leading cryptocurrency, has entered a price discovery phase, breaking past key resistance levels. Analysts suggest that if Bitcoin’s Price Temperature Indicator (BPT) reaches a value of 8, BTC could potentially hit $178,000 in the coming months.

The key drivers for this include:

- Increased accumulation by institutional investors

- Rising demand for Bitcoin ETFs

- Favorable macroeconomic conditions, such as lower inflation and monetary policy easing

2. Altcoin Market Performance

While Bitcoin leads the rally, several altcoins are also experiencing substantial gains. Key performers include:

- Solana (SOL): Continues to outperform Ethereum due to lower fees and faster transaction speeds【23】.

- Binance Coin (BNB): Remains strong due to growing utility within the Binance ecosystem.

- XRP: Benefiting from legal clarity in the ongoing Ripple vs. SEC case.

- DeFi Tokens: Many decentralized finance (DeFi) projects have seen a resurgence in TVL (Total Value Locked), signaling increased user confidence【24】.

3. Institutional and Regulatory Developments

Institutional interest has been growing rapidly, with major firms increasing their exposure to crypto assets. The following developments have contributed to today’s market upswing:

- Bitcoin ETF Approval: The recent launch of spot Bitcoin ETFs in the U.S. and South Korea is attracting significant institutional investment.

- Regulatory Clarity: Pro-crypto policies from governments, particularly in the U.S., have bolstered market confidence.

- Tokenization of Assets: The expansion of tokenized real-world assets (RWAs) is unlocking new investment opportunities【24】.

4. Macroeconomic and Political Factors

The broader financial environment is also playing a crucial role in the crypto market’s upward movement. Key elements include:

- Trump’s Potential Crypto-Friendly Policies: With Donald Trump set to take office, many anticipate more favorable regulatory conditions for crypto markets【23】.

- Global Financial Market Trends: Declining interest rates and reduced inflationary pressures are making risk assets, including crypto, more attractive.

- Institutional Hedging Against Fiat Devaluation: Investors are increasingly using Bitcoin and stablecoins as hedges against fiat currency devaluation.

Technical Analysis: What the Charts Say

Technical indicators suggest that Bitcoin and other cryptocurrencies are in a strong bullish trend. Some notable observations include:

- RSI (Relative Strength Index): Bitcoin’s RSI is trending in bullish territory, signaling continued upward momentum.

- Moving Averages: The 50-day moving average has crossed above the 200-day moving average (a “golden cross”), indicating a long-term uptrend.

- Volume Analysis: Increasing trading volume confirms strong buying pressure.

The Future Outlook for Crypto Markets

Looking ahead, several factors will determine whether this rally sustains:

- Bitcoin Halving Impact: The supply reduction caused by Bitcoin’s halving is expected to continue influencing price movements positively.

- Further Institutional Adoption: Large financial institutions are expected to increase their exposure to crypto assets.

- Regulatory Developments: If the U.S. and other major economies continue providing regulatory clarity, it could lead to further market expansion.

- Technological Innovations: Advances in blockchain scalability, smart contract security, and DeFi applications could drive further growth.

The crypto market moving up today (March 24, 2025) is driven by a combination of factors, including Bitcoin’s price discovery phase, strong altcoin performance, growing institutional interest, favorable macroeconomic conditions, and technical indicators. While volatility remains a constant feature of the crypto industry, the overall sentiment is bullish, and many analysts predict further price increases in the coming months.

Investors should remain cautious and keep an eye on global financial developments, regulatory changes, and key technical indicators to navigate the market effectively.

Read about Bitcoin – How to Solve Double Spend Problem.